Introduction to Doge and Elon Musk’s Involvement

The Department of Government Efficiency (Doge) has gained prominence due to its ambitious goal of augmenting government effectiveness while minimizing wasteful expenditure. In this context, the recent claims attributed to Elon Musk, suggesting that Doge has potentially saved the US government $180 billion, propel the discourse surrounding both the organization’s initiatives and Musk’s futuristic vision for reforming governmental inefficiencies. As a prominent figure in technology and innovation, Musk’s involvement adds a layer of intrigue given his acute focus on progressive methodologies to streamline operations.

Elon Musk’s affinity for disruption and improvement permeates various sectors, and his role in Doge is no exception. By collaborating with influential policymakers during the Trump administration, he embraced a unique opportunity to advocate for transformative practices within federal frameworks. His engagement illustrates how private sector approaches can be harmonized with public sector operations to achieve synergetic growth. Musk’s futuristic ambitions align well with Doge’s foundational principles, emphasizing accountability, transparency, and ultimately, economic savings.

Furthermore, the synergy between Musk’s innovative mindset and the objectives of Doge has catalyzed discussions about an elon musk doge savings goal. Advocates of the initiative argue that the potential financial benefits could regenerate trust in government programs while redirecting funds to essential public services. By exploring the intricacies of this relationship, it becomes apparent that the claims surrounding significant savings might not merely be hyperbole but rather an indication of pragmatic advancements spurred by technological integration.

In this discourse, we will examine the specific claims Musk has made regarding governmental savings, the strategies employed by Doge, and the future implications for both the US government and the broader public. Such an analysis will allow for a more nuanced understanding of the interplay between economic strategy and influential figures like Musk in revolutionary fiscal governance.

The Initial Claims: Analyzing Musk’s $2 Trillion Savings Projection

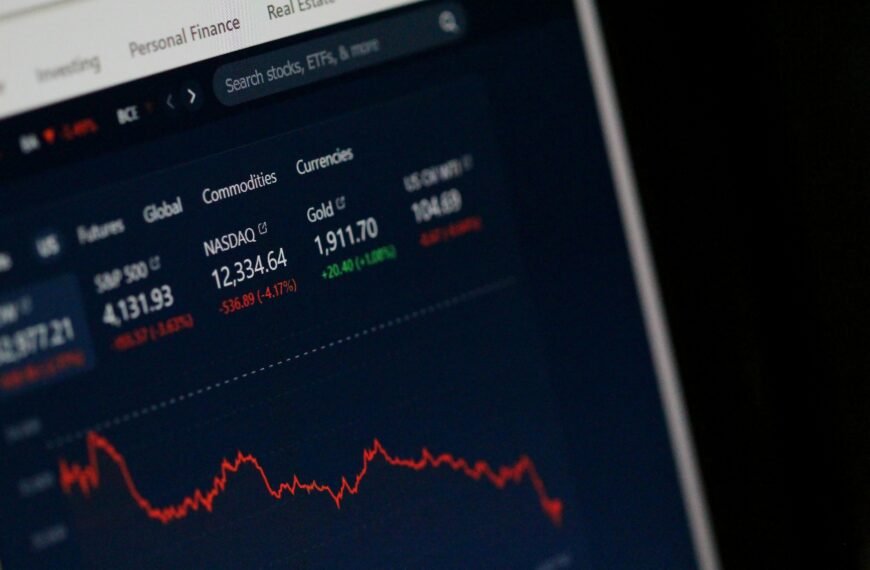

Elon Musk, the CEO of Tesla and SpaceX, has made bold claims regarding the potential financial impacts of Dogecoin, a cryptocurrency originally created as a joke. Specifically, Musk posited that the implementation of Dogecoin technology could lead to a staggering reduction in U.S. government spending by up to $2 trillion. This assertion challenges conventional views on fiscal management and the role of digital currencies in mainstream economy.

To understand the foundation of Musk’s $2 trillion savings projection, one must examine his methodology. The claim presumes that by adopting decentralized currency systems like Dogecoin for various government transactions, significant costs associated with traditional banking and administrative processing would be eliminated. The reasoning hinges on the premise that Dogecoin transactions offer efficiency and lower fees when compared to current systems used within government agencies.

Moreover, Musk’s projection isn’t solely about transactional efficiency. It extends to indirect savings that may result from streamlined operations, reduced fraud, and enhanced transparency in financial dealings. The hypothesis suggests that moving to a cryptocurrency like Dogecoin could also encourage more efficient tax collection and better allocation of resources. However, critics argue that this analysis lacks rigorous economic modeling and fails to account for the volatility and regulatory uncertainties surrounding cryptocurrencies.

Additionally, it is essential to realize that while the notion of harnessing Dogecoin for substantial savings is intriguing, such a transition would require a robust framework to manage risks associated with market fluctuations. Therefore, despite attracting interest, Musk’s claims merit a closer examination to ascertain their plausibility and implications.

In light of the current financial landscape, the avid discourse surrounding the elon musk doge savings goal reflects deeper considerations related to the future of currency and governmental fiscal policy.

Breakdown of the Reported $180 Billion Savings

The recent claims regarding a purported $180 billion savings attributed to Dogecoin have sparked a considerable amount of discourse, particularly concerning the veracity and the underlying details. To properly understand this figure, it is essential to dissect the components contributing to this purported savings achievement across various government programs and departments. A comprehensive review of the budget reports reveals a range of grant cuts and agency reductions facilitating this claimed financial result.

Firstly, significant cuts have been applied to federal grants, particularly those not deemed essential in the wake of prevailing economic conditions. Programs such as renewable energy incentives and various subsidy mechanisms have faced scrutiny and subsequent budget reductions. The resultant savings impact reflects a strategic pivot towards bolstering essential services, which supposedly aligns with the expectations set forth by proponents of the Dogecoin savings narrative, including influential figures like Elon Musk.

Furthermore, several government agencies, particularly those involved in budget-intensive projects, have experienced a reevaluation of their funding. This investigative approach seeks to eliminate redundancy and streamline expenditures. Agencies engaged in technology and innovation initiatives were notably affected. While this reduction might contribute to the touted savings figure, critics argue that the implications for innovation and development could negatively affect long-term economic growth and stability.

Additionally, it is crucial to consider external factors influencing spending patterns. The rise and popularity of cryptocurrencies, epitomized by the Dogecoin phenomenon, implies a cultural shift in financial management. This shift may be influencing budgetary decisions indirectly. However, the actual realization of the “$180 billion savings” remains a contentious issue, necessitating further scrutiny for context and accuracy.

In conclusion, the breakdown of the reported savings requires a critical lens to assess its genuine impacts on the multifaceted landscape of government funding and expenditures. As debates continue to surround the claim, understanding these complex causal relationships remains imperative.

The Political Context: Musk and Trump’s Relationship

The relationship between Elon Musk and Donald Trump has been a topic of interest, particularly given their respective influence on the American economy and technology sectors. Musk, as the CEO of several cutting-edge companies such as Tesla and SpaceX, and Trump, as the former President of the United States, have engaged in a series of public interactions that have shaped perceptions around initiatives like Dogecoin.

Musk’s advocacy for Dogecoin, often characterized by his humorous social media posts, has sometimes aligned, yet occasionally conflicted, with Trump’s political narrative. For instance, during Trump’s presidency, Musk was considered a prominent voice in the technological innovation space. Both figures have capitalized on social media to amplify their messages, leaving an indelible mark on financial markets, including cryptocurrencies. This dynamic has undoubtedly impacted the visibility and acceptance of ventures like Doge, particularly in light of Musk’s assertions regarding the digital currency’s saving goals, such as the elon musk doge savings goal.

Trump’s approach to cryptocurrency has been more cautious; he has expressed skepticism about the long-term viability of such digital assets. This divergence illustrates the complexities of their relationship. While Musk promotes a vision of financial innovation through initiatives like Dogecoin, Trump’s more conservative stance creates a contrast that affects the overall credibility of Doge’s initiatives. Additionally, their exchanges on platforms such as Twitter and other social media serve to mobilize followers, often resulting in significant fluctuations in the markets associated with Dogecoin.

In this intricate dance of influence and public sentiment, the interplay between Musk and Trump serves as a focal point in understanding the potential and pitfalls of Dogecoin’s efforts to gain traction as a legitimate financial asset. The fluctuating opinions from each figure offer insight into how political relationships can impact latest trends in technology and finance.

Consequences of Doge’s Budget Cuts

The introduction of Dogecoin (Doge) as a catalyst for budgetary changes has sparked discussions of significant implications for public welfare and essential services across the United States. A notable impact has been the cuts made to state health departments, which are crucial in managing public health crises and addressing community health needs. With dwindling resources, many health departments have been forced to scale back their preventive programs, leading to potential increases in diseases that could have been managed or mitigated. These budget cuts may pose a risk to the nation’s health, challenging the ability of departments to respond effectively to emerging threats and maintain overall population health.

Moreover, the reductions in scientific research funding have raised alarm among researchers and institutions relying on these financial resources to drive innovation and discovery. The inability to secure sufficient funding can lead to stagnation in advancements in critical sectors such as medicine and technology. Cutting-edge research often depends on consistent funding streams, and without adequate support, the collaboration among scientists can suffer, potentially delaying breakthroughs that would benefit society. The ramifications of underfunding scientific inquiry not only hinder individual projects but also erode the collective knowledge and competitive advantage that a nation relies upon on a global scale.

Additionally, the impact of budgetary cuts to the Consumer Financial Protection Bureau (CFPB) cannot be overlooked. This agency plays a vital role in safeguarding consumer interests and regulating financial institutions. Reduced funding can limit the CFPB’s capacity to enforce regulations, address complaints, and conduct oversight of potentially exploitative practices. As the financial landscape evolves, especially with the influence of cryptocurrencies like Doge, a weakened CFPB may jeopardize consumer trust and safety. Overall, the consequences of these cuts woven into the fabric of public services may compel policymakers to reassess the balance between economic experimentation and the essential needs of citizens.

Public Reaction and Criticism

Elon Musk’s assertions regarding the potential savings of $180 billion for the U.S. government through the integration of Dogecoin have generated significant public discourse. The response has been polarized, encompassing both endorsement and vigorous criticism. A considerable faction of the cryptocurrency community views Musk’s comments as a validation of Dogecoin’s value and potential in mainstream financial structures. Proponents argue that the unconventional approach to federal funding, as espoused by Musk, demonstrates a forward-thinking perspective, showcasing a willingness to embrace innovative financial solutions. The elon musk doge savings goal appears to resonate with followers who appreciate the intersection of technology and governance, fostering a narrative where cryptocurrency could play a transformative role in the economy.

Conversely, skepticism has arisen from various sectors, particularly among financial experts and critics of cryptocurrency. Detractors question the practicality and ethical implications of Musk’s suggestions. They argue that the proposed cuts in federal funding, if enacted, could lead to severe consequences for public services and welfare programs, disproportionately affecting vulnerable populations. Critics assert that while the elon musk doge savings goal may sound appealing, the real-life application of such drastic financial strategies can result in unintended adverse outcomes. This sentiment has been amplified by concerns over Musk’s influence; some believe that his promotion of Dogecoin could foster irresponsible speculation and exacerbate market volatility.

In addition, accusations have surfaced surrounding the motivation behind such claims. Some observers speculate that Musk’s advocacy for Dogecoin is rooted more in personal gain than civic duty, raising questions about the integrity of his intentions. Thus, as public figures like Elon Musk publicly endorse unconventional financial approaches, the community remains divided, weighing the potential benefits of the elon musk doge savings goal against the ethical implications and potential repercussions of altering federal funding structures.

Potential Long-term Effects on Government Efficiency

The claim that Doge has contributed to substantial budget cuts within the U.S. government raises critical questions about potential long-term effects on government efficiency. As we analyze the implications of these cuts, it is essential to consider historical contexts that have accompanied similar austerity measures and their repercussions on public services and governmental trust. The notion behind utilizing Doge as a tool for savings hinges on the promise of innovation and cost-effectiveness in public expenditure.

Historically, periods of reduced funding have led to mixed outcomes. For instance, during the early 2010s, some governments embraced austerity policies under the premise that streamlined budgets would foster greater efficiency. While certain administrative sectors saw short-term savings, others experienced significant declines in essential services, leading to strained public trust. The question remains: will the current approach of leveraging cryptocurrency, namely Doge, lead to sustainable improvements in government productivity, or will it inadvertently undermine critical public services?

The integration of Elon Musk’s ambitious vision for Doge into the government’s budgetary framework illustrates both optimism and caution. Proponents argue that the infusion of a dynamic digital asset can modernize state finances, potentially achieving the elon musk doge savings goal by harnessing the asset’s volatility and growth potential. However, skeptics highlight the risks attached to relying on speculative assets, which may render budgetary planning highly unpredictable and susceptible to market fluctuations.

As the U.S. government explores this innovative path, it must also prioritize transparency and accountability. Trust in government operations is rooted in citizens’ confidence that their needs are met. Should Doge ultimately compromise essential public services or create uncertainty in funding, the long-term repercussions may overshadow any immediate gains. Thus, a balanced approach that considers both the potential savings from Doge and the need for stable public services will be critical for achieving lasting improvements in governmental efficiency.

Alternative Solutions for Federal Spending

In light of Elon Musk’s claims regarding the potential savings attributed to Dogecoin, it becomes imperative to explore alternative solutions for reducing federal spending that can maintain the viability of essential services. Various experts and economists have proposed several methodologies aimed at creating a more efficient financial framework within federal expenditure.

One prominent suggestion is the implementation of comprehensive budget reviews to identify wasteful spending across various departments. Experts argue that regular assessments can unearth inefficient expenditures that do not contribute to public welfare. Such audits might uncover programs that are past their prime or entirely redundant, thereby allowing for a reallocation of resources that can enhance service delivery without necessitating drastic cuts.

Additionally, an increasing number of policymakers advocate for the adoption of technology-driven solutions. The government could leverage advancements in artificial intelligence and data analytics to streamline operations and improve resource allocation. By employing innovative technologies, the government could potentially minimize administrative costs, while ensuring that essential services like healthcare and education remain adequately funded.

Furthermore, there is a growing discourse around the reduction of tax loopholes and a more equitable tax structure. By reforming the tax system to close loopholes that primarily benefit corporations and the wealthiest individuals, the government could potentially increase its revenue. This approach not only maintains funding for critical services but also instills a sense of fairness in the tax system.

When juxtaposing these solutions with the proposed doge savings initiatives, it becomes evident that alternative strategies may offer a more balanced approach. While the elon musk doge savings goal presents an intriguing notion, relying solely on cryptocurrency innovations might not suffice. Solutions that hinge on transparency, accountability, and technology can provide a more stable foundation for future federal spending reductions.

Conclusion

The discourse surrounding Dogecoin and its unintended effects on government finances illustrates a complex interplay between cryptocurrency and fiscal policy. Under the leadership of Elon Musk, Dogecoin has garnered substantial media attention and public interest, leading to multifaceted implications for both individual investors and broader economic strategies. The claims regarding the elon musk doge savings goal of potentially saving the US government $180 billion are bold and, on the surface, enticing. However, the reality is considerably more nuanced.

Critically evaluating Musk’s assertions, several factors come into play. First, while the popularity of Dogecoin and its acceptance as a form of payment might contribute to new revenue streams and a diversification of economic activity, attributing a specific amount of savings to its implementation remains challenging. The speculative nature of cryptocurrencies, including Doge, raises concerns about their stability and long-term viability as solutions for government efficiency initiatives.

Moreover, the sustainability of these savings depends on numerous external variables, such as market trends, regulatory frameworks, and general public sentiment towards cryptocurrencies. Analysts and policymakers must approach Elon Musk’s claims with caution to avoid overestimating the financial ramifications of embracing digital currencies within governmental operations.

Looking ahead, it is crucial for government entities to engage in experiments with innovative financial strategies, including the use of cryptocurrencies like Doge. However, such endeavors should be meticulously assessed and balanced against established fiscal principles. The exploration of elon musk doge savings goal should ultimately push broader discussions on how innovative technologies can complement traditional financial systems while ensuring regulatory compliance and stability. Future studies will need to thoroughly investigate these claims, ensuring a nuanced understanding of how cryptocurrencies can truly contribute to government efficiency and fiscal responsibility.

We publish content to inspire and motivate the new generation.