Introduction to Budgeting for Online Entrepreneurs

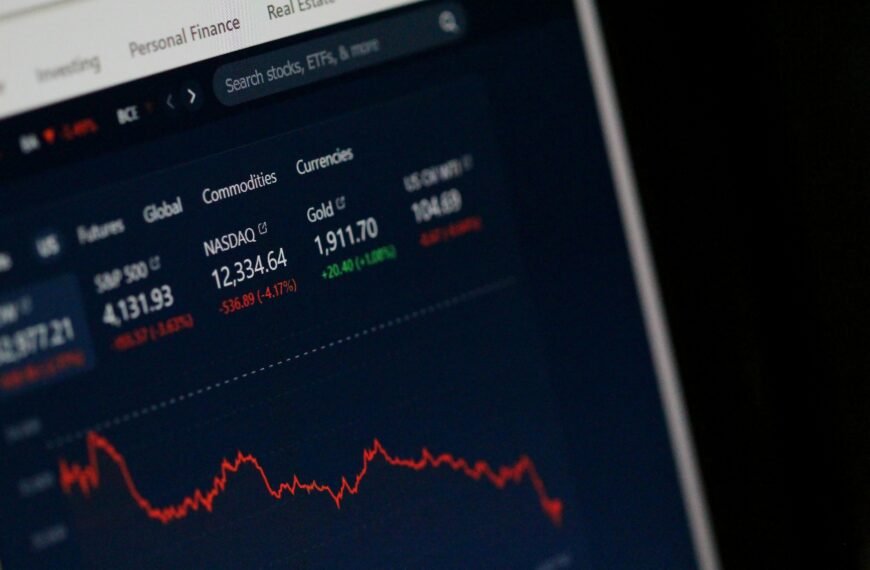

Budgeting is a critical component for online entrepreneurs seeking to establish and grow their businesses successfully. An effective budget serves as a roadmap that guides financial decisions and allocations. For entrepreneurs, particularly those operating online, understanding the significance of a well-structured financial plan can mean the difference between thriving and merely surviving in the competitive digital landscape.

When starting an online business, cash flow management becomes essential. An entrepreneur budget template can assist in tracking income and expenses meticulously. This clarity in financial standing allows entrepreneurs to make informed decisions about spending, investments, and potential areas for cost reduction. A robust small business budget planner not only helps in understanding current finances but also contributes to future forecasting, which is crucial for sustainable growth.

Moreover, budgeting enables entrepreneurs to allocate resources efficiently. By identifying fixed and variable costs, as well as potential earnings, an accurate budget can help prioritize investments and allocate funds to the most profitable areas of the business. This financial vigilance mitigates risks associated with overspending and underestimating costs, which can be detrimental to emerging businesses. Effective financial planning fosters an environment where online entrepreneurs can experiment and innovate, knowing they have a financial buffer to support their activities.

In essence, a proactive approach to budgeting empowers entrepreneurs to stay agile and responsive to changes in the market. By employing an entrepreneur budget template or a small business budget planner, they are equipped to track their financial health and make strategic decisions that promote longevity and success. It is through diligent budgeting that online business owners can navigate the complexities of their financial landscape, setting the stage for expansion and increased market presence.

Key Components of a Budgeting Template

When developing an entrepreneur budget template, it is essential to include several key components that will provide a clear financial roadmap for a small business. The first critical element is income projections. Entrepreneurs should meticulously estimate their expected revenue based on market research, historical data, and realistic sales goals. Accurate income forecasting enables business owners to anticipate cash flow, make informed decisions, and invest wisely in growth opportunities.

Following income projections, entrepreneurs must account for fixed and variable expenses. Fixed expenses are those that remain consistent each month, such as rent, utilities, and salaries, while variable expenses may fluctuate, including marketing costs and cost of goods sold. By detailing these expenses in a small business budget planner, entrepreneurs can gain insights into their spending patterns and identify areas where cost reductions may be possible.

In addition to regular expenses, one-time costs should also be included in the budgeting template. These may consist of initial startup costs, equipment purchases, or marketing campaigns. Including these one-time expenses allows entrepreneurs to plan for potential cash shortages and ensure sufficient funds are allocated to cover them when the time comes.

Finally, savings targets play a pivotal role in any budgeting template. It is prudent for entrepreneurs to set aside a percentage of their earnings for emergencies, business expansion, or long-term investments. By establishing these financial goals within their budget, entrepreneurs cultivate financial discipline and lay the groundwork for future success.

Overall, these components—income projections, fixed and variable expenses, one-time costs, and savings targets—form a robust framework for an entrepreneur budget template, assisting entrepreneurs in navigating their financial landscape successfully and supporting their specific business goals.

Types of Budgeting Templates for Entrepreneurs

Budgeting is a critical element for entrepreneurs embarking on online business ventures. The successful management of financial resources often hinges on selecting the appropriate budgeting templates that cater to specific needs. Various types of budgeting templates serve distinct purposes and can aid in navigating the complexities of startup costs, operational expenses, and revenue forecasting.

One foundational tool is the basic budgeting spreadsheet. This straightforward format allows entrepreneurs to track income and expenses comprehensively. Entrepreneurs can customize these spreadsheets to reflect their unique operational processes, making them ideal for those new to financial management. A small business budget planner based on a basic spreadsheet can effectively assist with monitoring daily expenditures and ensuring that overall financial goals are met.

Zero-based budgeting formats represent another effective option, requiring entrepreneurs to justify every expense from scratch. This methodology promotes resourcefulness, making it particularly beneficial for startups and those seeking to maximize the utility of limited funds. By compelling entrepreneurs to evaluate the necessity of each item, a zero-based budgeting approach fosters a disciplined financial mindset.

Cash flow forecasting templates further empower entrepreneurs by projecting future cash needs, helping to cultivate a healthy financial ecosystem. Understanding cash flow dynamics becomes critical in preventing unforeseen shortfalls. These templates facilitate strategic decision-making, allowing for adjustments to be made in anticipation of inevitable fluctuations in revenue.

Lastly, flexible budgeting models can adapt as conditions change, making them suitable for entrepreneurs with varying market influences. This adaptability is beneficial for businesses that may experience growth spurts or seasonal fluctuations. Entrepreneurs using these models can create a dynamic financial roadmap that aligns with evolving business strategies and objectives.

By employing a combination of these budgeting templates, entrepreneurs can ensure a robust financial framework supporting their online businesses, ultimately leading to sustainable growth and success.

Creating Your Own Budgeting Template

Establishing an effective budgeting template is crucial for entrepreneurs embarking on their online business journey. The first step is selecting the appropriate software tools to facilitate this process. Popular choices include Microsoft Excel and Google Sheets due to their versatility and ease of use. Both platforms offer various features, such as formulas and automated calculations, making it simpler to manage financial data.

Next, it is essential to set up specific categories for income and expenses. This categorization allows for better tracking and analysis of financial performance. Start by listing predictable income streams, such as product sales or subscription services. Then, create expense categories, including fixed costs like rent and variable costs like marketing expenses. A well-structured entrepreneur budget template should have clearly defined sections for each income source and expense type, allowing for a comprehensive overview of the business’s financial situation.

Customization is another significant aspect of creating a personal budgeting template. Each online business presents unique financial circumstances, so adapting your template to meet these needs is vital. Consider adding fields for seasonal variations in income or one-time expenses that may arise. By tailoring the template to reflect your business’s specific financial dynamics, you can enhance its effectiveness as a small business budget planner.

Moreover, maintaining the template is essential to ensure it remains a useful financial tool. Regularly updating the entrepreneur budget template with actual figures helps to identify trends and make informed financial decisions. Scheduling consistent reviews, whether weekly or monthly, can ensure your budget reflects the current state of affairs. By embracing these practices, entrepreneurs can better navigate the complexities of online business operations, leading to informed financial planning and optimized growth opportunities.

Free Budgeting Template Resources

For entrepreneurs embarking on the journey of starting an online business, having access to effective budgeting tools is crucial. Fortunately, there are numerous free resources available that provide downloadable budgeting templates aimed at helping small business owners manage their finances efficiently. Below are some valuable online platforms that offer various budgeting templates suitable for any entrepreneur’s budget needs.

The Smartsheet website is a well-known tool that offers a variety of free budgeting templates, including an entrepreneur budget template. Their templates cater to different purposes, such as project budgeting and event planning, and are highly customizable to fit specific business needs. Users can easily input their data and monitor expenses and income effortlessly.

Another excellent resource is the Vertex42 website, which specializes in Excel templates. Their collection includes a small business budget planner that allows entrepreneurs to track their finances and forecast cash flows. Known for their user-friendly design, these templates are an ideal starting point for business owners who prefer spreadsheet format for their budgeting needs.

For entrepreneurs looking for a more simplistic approach, Google Sheets provides free templates within its platform. With a variety of options designed specifically for small businesses, users can select from several budgeting models that can be easily shared and edited in real-time. This collaborative aspect is especially beneficial for small business teams.

Lastly, the Indeed Career Guide features an easy-to-use startup budget template tailored for new business owners. This template guides entrepreneurs through the essential costs associated with launching a business, ensuring they remain aware of their financial constraints from the outset.

These resources provide a strong foundation for financial management and can significantly enhance the budgeting process for entrepreneurs. Utilizing these free budgeting templates is an effective way to maintain clarity and discipline in financial planning.

How to Use Budgeting Templates Effectively

To optimize financial management, entrepreneurs should harness budgeting templates effectively. An entrepreneur budget template serves as a foundational tool for tracking revenues and expenses, promoting sound fiscal decision-making. Regular updates to this template are essential; at least monthly engagements allow business owners to stay informed about their financial health. Keeping the budgeting template current helps to identify patterns in spending and revenue, which can inform tactical adjustments in real-time.

Additionally, analyzing the financial data captured in the small business budget planner can unveil critical insights. Entrepreneurs should pay close attention to variances between projected and actual figures. Regular analysis aids in understanding areas where costs may be higher than anticipated and where revenue can be bolstered. For instance, a business that consistently falls short in sales compared to the budget may need to reevaluate its marketing strategies or product offerings.

Moreover, setting realistic financial goals within the budgeting template is crucial. By leveraging past data, entrepreneurs can gauge achievable targets rather than aspirational figures that may set them up for disappointment. Utilizing historical trends, a small business budget planner can provide guidance on income expectations and expense limits, leading to more grounded business growth strategies.

As businesses evolve, so too should their budgets. Adapting requires not just modifying figures but also reassessing goals and forecasts. Successful entrepreneurs often revisit their budgeting templates quarterly, adjusting their plans based on market conditions, customer trends, and operational changes. A real-world example includes a tech startup that initially set aside a certain percentage of profits for product development. By reviewing their entrepreneur budget template quarterly, they were able to double their development budget during a spike in demand, successfully launching two new features ahead of competitors.

Common Budgeting Mistakes to Avoid

Budgeting is essential for entrepreneurs in establishing an effective financial strategy, particularly when starting an online business. However, many entrepreneurs fall prey to common budgeting mistakes that can hinder success. One significant error is underestimating expenses. New entrepreneurs often assume that the costs associated with running a business will be minimal. In reality, unforeseen expenses can arise, making it crucial to prepare for potential financial shortfalls. Utilizing an entrepreneur budget template can aid in outlining a more accurate forecast of expenses, encompassing overhead, marketing, and operational costs.

Another frequent mistake is failing to revise budgets regularly. An initial budget should not be viewed as static; it requires constant updating and reevaluation as the business grows or faces changes. Regularly adjusting a small business budget planner allows entrepreneurs to remain aligned with their financial goals and adapt to any shifts in the market or their own spending habits.

Furthermore, neglecting to track income accurately can lead to significant financial discrepancies. Entrepreneurs should consistently monitor their revenue streams and compare them against their anticipated figures. Proper income tracking ensures adequate cash flow management, which is vital for sustaining an online business. Integrating their income and expenses into an entrepreneur budget template can provide a clear picture of financial health.

Finally, many entrepreneurs fail to use their budget as a planning tool. A budget should serve as a roadmap, guiding business decisions and helping identify areas for growth and improvement. By viewing their small business budget planner not only as a financial tracker but also as a strategic tool, entrepreneurs can make informed decisions that align with their long-term business vision. Avoiding these pitfalls will significantly enhance budgeting practices, leading to greater financial stability and success.

The Role of Budgeting in Business Growth

Budgeting plays a pivotal role in the growth trajectory of any business, particularly for entrepreneurs starting online ventures. A well-structured entrepreneur budget template serves as a foundational tool for identifying potential opportunities for investments and understanding the financial landscape of a business. It allows entrepreneurs to outline their revenue expectations, forecast expenses, and plan for future financial needs. By employing a small business budget planner, entrepreneurs can make informed decisions that directly contribute to their growth and profitability.

One of the critical aspects of budgeting is its ability to help entrepreneurs control costs. Effective cost management ensures that business owners do not overspend and helps them maintain a positive cash flow. This financial discipline is especially vital in the dynamic online marketplace, where costs can fluctuate due to varying factors such as web hosting fees, advertising expenses, and product sourcing. Having a clear budget allows entrepreneurs to remain agile and responsive to changes, ensuring they can pivot their strategies without incurring unnecessary expenditures.

Resource allocation is another significant benefit derived from adequate budgeting practices. Entrepreneurs are often faced with the challenge of deciding which areas of their business to invest in, whether it’s marketing, product development, or customer service. A robust budget provides insights into the performance of different segments, allowing business owners to allocate resources more effectively and optimize their investments. Case studies of successful online businesses illustrate the positive impact of effective budgeting. Companies that have embraced comprehensive budget planning, utilizing templates tailored to their specific needs, have achieved remarkable scaling results.

The narrative surrounding budgeting and business growth highlights its importance and the distinct advantage it offers entrepreneurial ventures in today’s competitive environment.

Conclusion: Making Budgeting a Habit for Online Success

In today’s competitive online business landscape, effective budgeting is not merely an optional exercise; it is a fundamental component of sustained entrepreneurial success. Throughout this blog post, we have explored various budgeting templates and strategies designed specifically for online entrepreneurs. Implementing an entrepreneur budget template is essential for tracking income and expenditures accurately, ensuring that every financial decision is informed and strategic.

Utilizing tools like a small business budget planner can help entrepreneurs establish a clear financial roadmap. This allows for better resource allocation, timely adjustments to spending, and a proactive approach to financial hurdles. By consistently reviewing and updating their budgets, online business owners can make informed decisions that promote growth and sustainability. Regular assessment of financial performance helps identify patterns and trends, enabling entrepreneurs to adapt their strategies effectively.

Moreover, making budgeting a habitual practice can lead to numerous benefits, including reduced financial stress, improved investment opportunities, and enhanced overall decision-making. The discipline of financial planning encourages entrepreneurs to prioritize their goals and allocate resources in alignment with their vision. As the online market evolves, so too should the budgeting strategies employed; therefore, ongoing evaluation of the budgeting process must be woven into the fabric of business management.

We encourage readers to take the first step towards financial clarity by creating or refining their budgeting strategies today. Consider integrating an entrepreneur budget template into your routine or exploring a small business budget planner that aligns with your needs. Establishing effective budgeting practices as a habit is pivotal for anyone seeking long-term success in the dynamic world of online business.

We publish content to inspire and motivate the new generation.