When PayPal launched in 1999, it didn’t just make online transactions easier—it rewrote the global payment infrastructure. Suddenly, anyone with an email address could send and receive money instantly, securely, and across borders. That shift not only transformed e-commerce; it democratized financial access for millions.

Two decades later, we’re on the edge of a similar transformation—only this time, the currency isn’t dollars or euros. It’s personal data. And if Preska Thomas, founder of DebitMyData, has her way, her platform will be to the data economy what PayPal was to digital payments: the trusted, universal bridge between people and the systems that use their value.

The Currency You Don’t Know You’re Spending

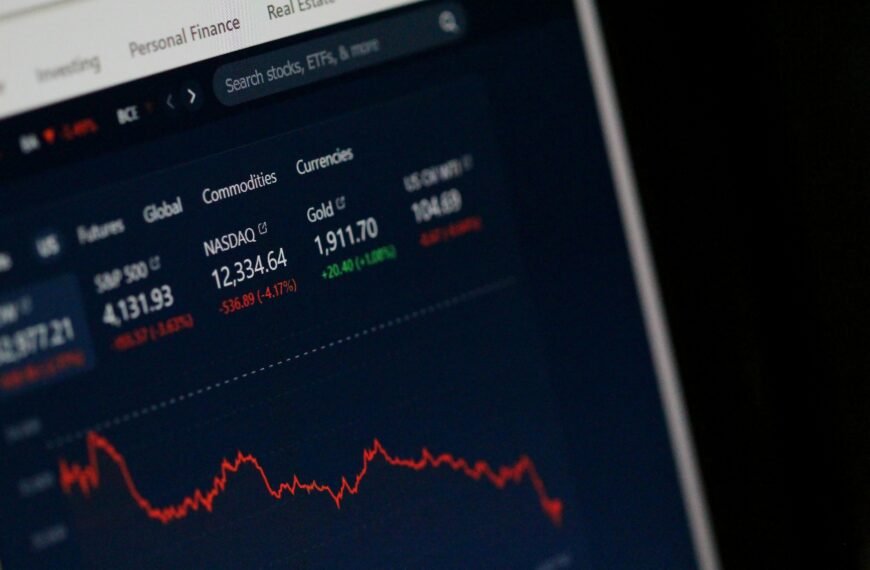

Right now, every click, search, purchase, and swipe you make generates a trail of data. That data is worth billions to advertisers, AI developers, and tech companies. In fact, personal data is now considered by many economists to be the most valuable commodity of the 21st century—surpassing oil in both demand and global impact.

But here’s the catch: most people have zero control over how it’s collected, traded, or monetized. You “pay” for free apps and platforms not with money, but with your behavioral patterns, location history, preferences, and personal details.

Preska sees this imbalance for what it is: the largest unpaid economic contribution in human history. “People generate value every second they’re online,” she explains. “It’s time they start seeing a direct return on that value.”

From Invisible Transactions to Direct Payouts

This is where DebitMyData steps in. Just as PayPal built a simple interface for moving money, DebitMyData is building a simple, secure interface for moving data value.

The core idea:

- Track where your data goes and how it’s being used.

- Set terms for who can access it.

- Receive direct payment when companies or AI systems use your information.

It’s financial technology—except the asset being transacted isn’t cash, it’s your identity’s digital footprint.

The Coming Personal Data Economy

Economists predict that by 2030, personal data transactions could represent a multi-trillion-dollar economy. AI systems like GPT-5 and upcoming superintelligent platforms require vast, high-quality datasets to operate effectively. That means your preferences, writing style, voice recordings, purchasing behavior, and even biometric data are the new gold.

If the last 20 years were defined by corporations monetizing that gold without paying the source, the next 20 could see platforms like DebitMyData flipping that equation.

Preska frames it in simple terms: “Imagine if every time your data trained an AI, you got a micro-payment—instantly, securely, anywhere in the world. That’s the system we’re building.”

Why “The PayPal of Personal Data” Is More Than a Metaphor

The PayPal comparison isn’t just marketing—it’s structural:

- Trust & Security

Just as PayPal became the intermediary people trusted to handle sensitive financial transactions, DebitMyData will become the trusted intermediary for sensitive personal data exchanges. - Universal Acceptance

PayPal worked because merchants adopted it at scale. DebitMyData is aiming for the same—partnering with AI developers, advertisers, and data-driven companies to create a standard payout system for data use. - User Control

PayPal gave people the ability to send money without giving away their bank details. DebitMyData will let people monetize data without surrendering raw personal information. - Borderless Payments

Just as PayPal made cross-border payments frictionless, DebitMyData will make cross-border data value transfers seamless—so a user in Asia can be paid instantly by a company in New York.

Advanced Conversations: AI, Data, and the New Social Contract

Preska’s vision extends beyond convenience. She’s proposing a new social contract for the AI age—one where personal data is treated as property, not just exhaust.

This matters because AI is entering a self-improving stage. Systems like GPT-5 can learn faster and adapt more deeply, but their intelligence is only as good as the human-generated data they consume. If individuals can’t control or profit from that contribution, the AI wealth gap (the economic divide between AI owners and everyone else) will explode.

DebitMyData is designed to insert fairness directly into that equation—making every person not just a user of technology, but a stakeholder in it.

The Future: Your Data, Your Dividend

In the early 2000s, few people imagined they’d be running businesses, making purchases, or sending rent money through PayPal. Now it’s second nature. In the same way, the idea of getting paid for data might feel futuristic today—but in a decade, it could be as common as a bank transfer.

DebitMyData isn’t just building an app—it’s building the rails for a new economy. And if history is any guide, the platforms that build the rails are the ones that define the era.

Preska Thomas knows this. The only question is how quickly the world will catch up.

We publish content to inspire and motivate the new generation.