Understanding Stock Market Bubbles

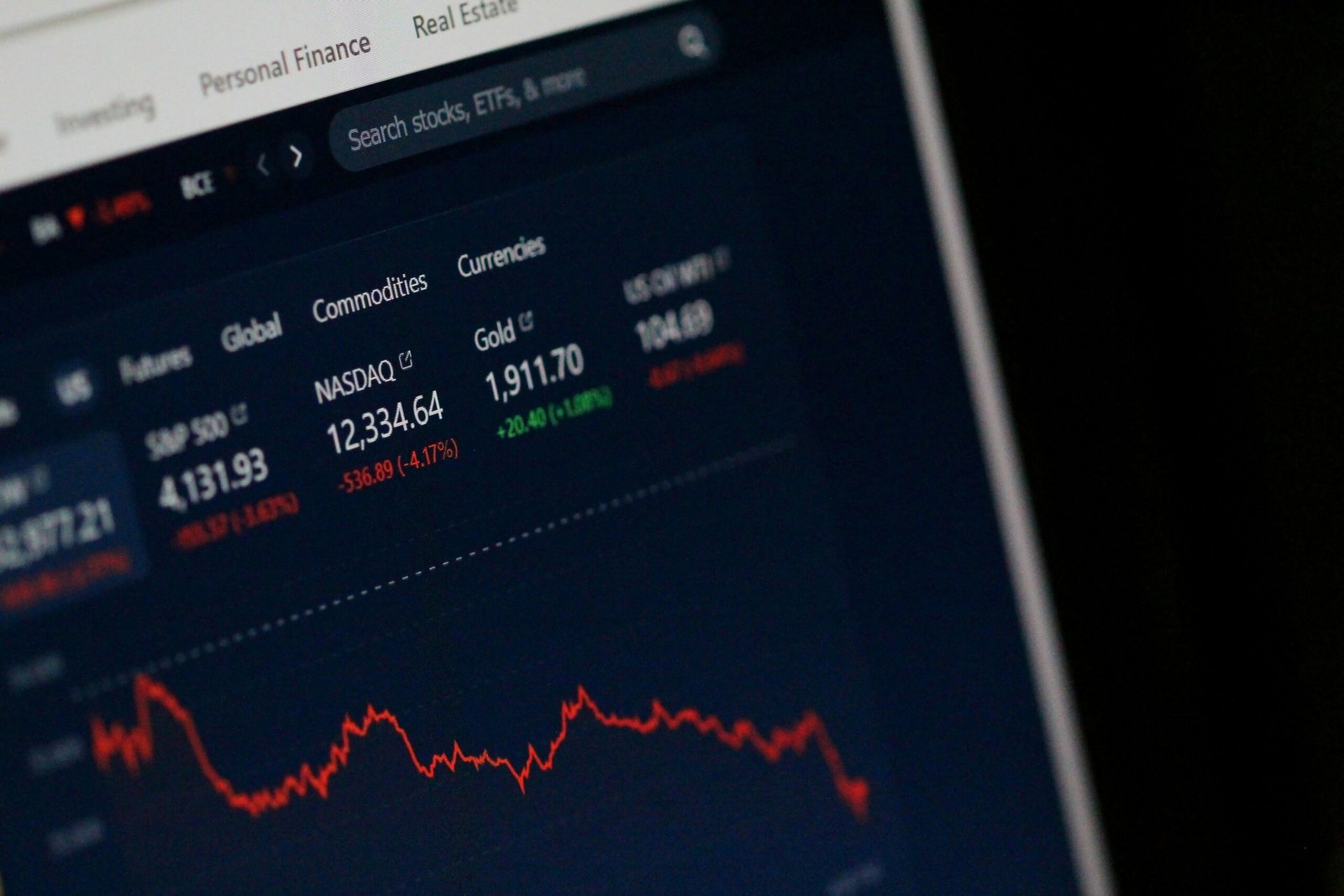

A stock market bubble can be defined as a phenomenon characterized by a rapid escalation in the prices of stocks, which is often not supported by the underlying fundamentals of the companies involved. This distortion leads to a significant divergence between stock prices and the intrinsic value of the businesses, driven primarily by excessive speculation and irrational investor behavior. The identifying traits of a bubble include a sharp, sustained increase in stock prices, euphoric investor sentiment, and an overwhelming sense that prices will continue to rise indefinitely.

Several psychological factors contribute to the formation of stock market bubbles. One of the most prominent is investor behavior, which often reflects an exaggerated sense of confidence in short-term market trends. As prices surge, a herd mentality may develop, where investors rush to purchase stocks in anticipation of further price increases. This collective behavior inflates the bubble further, creating an environment where rational analysis is overshadowed by the fear of missing out (FOMO). Market sentiment plays a crucial role in this dynamic, as positive news can amplify optimism while negative stimuli can lead to panic and rapid sell-offs.

Historically, there have been notable examples of stock market bubbles that provide valuable insights into their nature. The Dot-Com Bubble of the late 1990s is a prominent case, where the excessive speculation in internet-based companies led to inflated valuations that eventually collapsed. Similarly, the housing bubble leading up to the 2008 financial crisis serves as a stark reminder of how easily market exuberance can transform into severe instability. Understanding these examples is crucial for investors seeking to navigate volatile markets, especially those in search of guidance on how to invest in a stock market bubble, ensuring they remain vigilant and discerning.

Identifying a Bubble: Key Indicators

Recognizing a stock market bubble is crucial for investors looking to make informed decisions on how to invest in a stock market bubble. Certain key indicators can help identify these potentially perilous scenarios. A primary metric to consider is the price-to-earnings (P/E) ratio of stocks. When P/E ratios soar to levels significantly higher than historical averages, this often suggests that stocks are overvalued. It is essential to compare these ratios against the broader market and specific sectors, as a disparity may signal an impending correction.

Another critical indicator is the level of media coverage surrounding the stock market. In times of bubbling enthusiasm, financial news outlets often indulge in excessive reporting about stock surges and bullish market sentiment. This heightened media attention can lead to increased interest from novice investors, exacerbating the bubble as they pour money into rising stocks, often driven by fear of missing out.

Furthermore, unsustainable earning growth presents a red flag for investors. When companies report earnings growth that outpaces economic fundamentals or lacks a solid foundation, caution is warranted. Analyses of financial reports can reveal discrepancies between reported performance and actual market conditions, highlighting the risks of continued investment in overhyped stocks.

Additionally, monitoring the volume of speculative investments is vital for recognizing bubbles. A surge in trading volumes, especially for growth stocks or options, may indicate that investors are engaging in excessive speculation rather than employing sound investment strategies. Keeping a close watch on these levels can provide insights into market sentiment and serve as a warning sign that conditions may be ripe for a significant downturn.

By understanding these key indicators, investors can position themselves better to identify a stock market bubble and make educated decisions about how to invest during these turbulent times.

Risks Associated with Investing in a Bubble

Investing in a stock market bubble presents numerous risks that can lead to substantial financial losses. A bubble is characterized by an increase in asset prices driven by speculative demand rather than intrinsic value. When the bubble eventually bursts, it often results in a rapid price correction, leading to significant losses for investors who fail to exit the market in time. Those new to the market may be particularly vulnerable, as they may not fully comprehend the dynamics of how to invest in a stock market bubble and the associated dangers.

Furthermore, the emotional toll on investors during bubble situations cannot be understated. The fear of missing out (FOMO) can drive individuals to invest recklessly, lured by the promise of quick returns. Consequently, when the market begins to turn, emotions such as panic, regret, and frustration can overwhelm rational decision-making. This can lead to hasty choices, including selling at a loss or failing to adjust their investment strategy in light of changing market conditions. Understanding one’s psychological tendencies during these turbulent times is essential for effective risk management.

Effective risk management becomes crucial when navigating the uncertainties of a stock market bubble. Investors must gauge their risk tolerance prior to entering the market, taking into account their financial situation and investment objectives. Establishing clear, realistic goals and boundaries can help guide decision-making and protect against emotional responses that often exacerbate financial losses. Diversifying investments and implementing stop-loss strategies are additional measures that can help mitigate risks. To maintain financial stability, individuals should conduct thorough research and remain mindful of the volatile nature of the market, especially during an economic bubble. Understanding these principles can empower investors to make informed choices, reducing the potential adverse impacts associated with bubble investing.

Strategies for Investing During a Bubble

Investing in a stock market bubble requires a strategic approach to manage risks while capitalizing on potential opportunities. One of the primary strategies to consider is short selling, which involves borrowing shares to sell at current market prices with the intention of buying them back later at lower prices. This approach is particularly effective during overvalued market conditions. However, it necessitates a robust understanding of market dynamics and vigilant monitoring to avoid significant losses due to market volatility.

Another effective strategy is sector rotation. Investors may choose to identify which sectors are likely to outperform others during the prevailing market conditions. Typically, sectors that benefit during an economic expansion or that demonstrate strength amidst market euphoria can provide lucrative returns. By reallocating investment resources into these sectors, investors can enhance their portfolios while reducing exposure to more volatile segments of the market likely to face corrections.

Diversification also plays a critical role in mitigating risks associated with stock market bubbles. Spreading investments across various asset classes, sectors, and geographical regions helps prevent substantial losses if one segment underperforms. It’s essential to consider the correlation between chosen assets; ideally, they should have minimal correlation to maximize risk reduction. Furthermore, timing the market is essential during a bubble, but it must be approached cautiously. Research and analysis should guide any attempt to enter or exit positions in response to market conditions.

Maintaining a long-term perspective can provide clarity amid the chaotic nature of a bubble. Investors should focus on fundamental strengths of the companies they invest in rather than solely market-driven prices. Additionally, utilizing stop-loss orders can protect portfolios by automatically selling stocks when they reach a certain price, thereby limiting potential losses. These strategies combined equip investors with valuable tools on how to invest in a stock market bubble while enhancing overall financial resilience.

The Importance of Research and Analysis

When considering how to invest in a stock market bubble, comprehensive research and analysis become paramount for successful decision-making. In such volatile environments, understanding the fundamental indicators of a company can provide invaluable insights into its stability and growth potential. Investors should meticulously evaluate key financial metrics, such as earnings per share, price-to-earnings ratios, and historical performance trends, to gauge a company’s underlying value. This foundational analysis safeguards investors against making decisions based solely on inflated market sentiments.

Beyond individual company assessments, analyzing broader market trends can offer clarity on the overall market dynamics at play. Observing sector performance, investor sentiments, and stock volume can help identify whether a perceived bubble is supported by genuine economic fundamentals or driven by speculative fervor. Market trends highlight the relative strength and weaknesses among investment options, allowing investors to strategically position their portfolios in a bubble environment.

An equally crucial component of research involves comprehending macroeconomic indicators that influence market movements. Factors such as interest rates, inflation, and geopolitical developments can dramatically shape market conditions. By staying informed about these broader economic trends, investors can better navigate risks associated with bubbles, helping to predict potential market corrections before they happen. Furthermore, utilizing analytical tools and resources, such as financial news platforms, stock screeners, and economic reports, complements the research process. These resources can augment an investor’s capacity to analyze patterns, leading to more informed investment strategies.

In conclusion, conducting diligent research and analysis is essential when figuring out how to invest in a stock market bubble. By focusing on company fundamentals, market trends, and macroeconomic indicators, investors can craft strategies that withstand the potential pitfalls inherent in speculative market environments.

Psychological Preparedness for Market Volatility

Investing during a stock market bubble can be an emotionally taxing experience, as volatility can provoke fear and uncertainty among investors. To successfully navigate these turbulent times, it is essential to cultivate psychological resilience. One effective strategy is to develop a well-informed mindset. Keeping abreast of market trends, understanding economic fundamentals, and acknowledging different viewpoints can provide a balanced perspective, reducing anxiety associated with sudden market changes.

Investors should also establish a clear investment strategy that outlines long-term goals. Having a predetermined plan can mitigate emotional responses during market fluctuations. For instance, setting specific entry and exit points for investments can help maintain focus on financial objectives rather than short-term price movements. Additionally, diversifying one’s portfolio can alleviate the stress of relying on a single stock or sector, which is particularly crucial during a bubble when price corrections are common.

Another key strategy is to avoid panic selling. This behavior often results from emotional reactions rather than rational decision-making. To guard against this, investors can employ techniques such as reframing negative thoughts, reminding themselves that market downturns can also provide buying opportunities. Regularly assessing one’s emotional state and implementing mindfulness practices, such as meditation or journaling, can further enhance emotional resilience.

Moreover, seeking professional guidance can prove beneficial during times of high volatility. Financial advisors can offer objective insights and personalized strategies, helping investors stay centered and informed. Joining investment communities or forums can also provide support and shared experiences among peers facing similar challenges. By fostering a calm and rational mindset, investors can better navigate the complexities of how to invest in a stock market bubble, making more informed decisions despite the inherent unpredictability of the market.

Making the Exit: Timing Your Investments

Exiting an investment during a stock market bubble requires careful planning and an acute awareness of market signals. Understanding how to invest in a stock market bubble necessitates recognizing the signs that may indicate a peak. These signs may include elevated price-to-earnings ratios, unusual trading volumes, and market sentiment driven more by speculation than by fundamentals. A sudden surge in social media chatter can also serve as a potential warning signal, as excessive hype often precedes a market correction.

Setting profit objectives is crucial when navigating the exit process. Investors should establish clear goals about their desired gains and the conditions under which they will sell. This might involve predetermined levels of profit-taking or even stop-loss orders that can help mitigate losses if the market turns against them. Having these targets can help prevent emotional decision-making, which often leads to negative outcomes during volatile market conditions.

Additionally, an exit plan is paramount for anyone looking to invest wisely during a bubble. This plan should include strategies for liquidating positions effectively. One common technique is gradual selling, where an investor incrementally sells off portions of their holdings. This not only minimizes the risk of missing out on further gains but also protects against abrupt market downturns. Scaling out can be particularly effective in a bubble, allowing investors to maintain exposure while gradually reducing their risk as they observe market movements.

Incorporating systematic assessment of market conditions into your exit strategy can provide a structured and disciplined approach to investing during these precarious times. By carefully monitoring indicators and adhering to a well-defined exit plan, investors can better position themselves to navigate the complexities of exiting an investment in a stock market bubble.

Learning from the Past: Historical Lessons

Understanding how to invest in a stock market bubble requires a thorough examination of historical precedents. Notable bubbles, such as the Dot-com Bubble of the late 1990s and the Housing Bubble leading up to the 2008 financial crisis, provide meaningful insights for today’s investors. Both these scenarios exemplified how speculative enthusiasm can lead to inflated asset prices that do not reflect underlying economic realities.

The Dot-com Bubble is a quintessential example where investor optimism drove technology stock valuations to unprecedented levels. Many companies with little more than a business plan saw their stock prices soar. By 2000, the market corrected itself dramatically, leading to enormous financial losses. From this, investors should learn the importance of due diligence. Evaluating a company’s fundamentals and potential for sustainable growth is crucial in mitigating risks associated with bubbles.

Similarly, the Housing Bubble illustrated how easily market behavior can be influenced by speculation. It was fueled by subprime mortgages and an unyielding belief in ever-increasing property values. The eventual crash not only destabilized financial markets but also impacted the global economy significantly. This scenario serves as a stark reminder to investors about the dangers of complacency regarding property investments, highlighting the necessity of a robust risk assessment strategy.

Both bubbles signify a common theme: the cyclical nature of markets is often propelled by irrational exuberance. Investors frequently repeat historical mistakes by failing to recognize the indicators of a bubble, such as skyrocketing valuations, dwindling fundamental support, and an overly optimistic market sentiment. To navigate such environments effectively, awareness of these recurring elements proves invaluable. By critically analyzing historical trends, modern investors can better position themselves to strategize effectively on how to invest in a stock market bubble and safeguard their portfolios against similar pitfalls.

Conclusion

In an ever-evolving financial landscape, understanding how to invest in a stock market bubble becomes essential for both seasoned and novice investors. Throughout this blog, we have explored pivotal strategies and insights aimed at fostering a more informed approach to navigating potential market bubbles. Awareness of historical trends and occurrences of market bubbles empowers investors to identify patterns that could signal impending volatility.

Conducting thorough research is vital in this context. Investors must remain attuned to various economic indicators, market sentiments, and sector performances; such diligence will enhance decision-making capabilities. Additionally, diversifying investments serves as a protective measure during periods of uncertainty and can mitigate the risks associated with a bubble burst. Allocating resources across different asset classes can provide a buffer when market conditions sharply decline.

Strategic planning is equally critical in these turbulent times. Establishing clear investment goals and maintaining discipline in the face of market exuberance aids in making rational choices rather than emotional ones. Investors should continuously assess their portfolios and be flexible enough to pivot strategies when necessary, particularly when warning signs emerge. Furthermore, focusing on long-term value rather than short-term gains can insulate investments from the unpredictable nature of market bubbles.

Ultimately, cultivating an investment acuity that combines vigilance with optimism is paramount. Recognizing that the potential for future stock market bubbles remains a reality, investors should approach such scenarios with caution and a well-defined strategy. By enhancing awareness and employing rigorous research, individuals can master the art of navigating these economic phenomena with confidence.

We publish content to inspire and motivate the new generation.