Introduction to Low-Cost Investments

Low-cost investments represent a strategic approach for new entrepreneurs seeking to enter the market with minimized financial risk. These investments require a relatively small initial capital but present an opportunity for substantial returns, making them an attractive option for those starting their entrepreneurial journey. By focusing on affordable and potentially lucrative avenues, new entrepreneurs can allocate their resources more efficiently and build a foundation for future growth.

For novice investors, the landscape of low-cost investments can seem daunting. However, understanding their nuances is crucial for maximizing the benefits they offer. These ventures not only help in preserving capital but allow entrepreneurs to experiment with diverse business ideas without the pressure of large financial commitments. Additionally, the low entry barriers and reduced overhead costs associated with these investments mean that even individuals with limited funds can participate in wealth creation.

Another key advantage of low-cost investments is the flexibility they provide. Entrepreneurs can use their earnings from these investments to reinvest in their ventures or explore other promising opportunities. As a result, they can gradually develop a robust portfolio that can adapt to changing market conditions. This process allows beginners to learn and build experience while steadily increasing their financial footprint. In this context, low-cost investments can be seen as one of the best investments for beginners looking to navigate the complex world of entrepreneurship. Optimal utilization of initial capital is vital for any startup; therefore, identifying the right low-cost investment avenues can lay the groundwork for long-term success.

Understanding Your Own Skills and Interests

Before embarking on any investment journey, particularly for new entrepreneurs, it is vital to conduct a thorough self-assessment of one’s skills and interests. This foundational understanding can significantly influence the selection of low-cost investments and can steer beginners towards opportunities where they are more likely to succeed and achieve substantial returns. By aligning investment choices with personal abilities and passions, entrepreneurs can capitalize on their strengths, enhancing their overall effectiveness in the investment realm.

One of the primary advantages of identifying personal skills is the increased likelihood of making informed decisions. For example, an individual with a background in marketing may find it easier to invest in a startup that requires strong promotional strategies. Conversely, someone with technical expertise might excel in investing in technology-driven ventures. This natural affinity enables new entrepreneurs to not only comprehend the intricacies of the businesses they invest in but also to contribute meaningfully, which can potentially lead to higher profit margins.

Furthermore, entrepreneurs should consider their interests as part of this evaluation process. Engaging in investments that resonate personally can foster motivation and resilience, especially during challenging times. Whether it’s investing in sustainable businesses, local startups, or digital assets, aligning investments with personal passion can yield a deep emotional connection to the business’s success, which might not only enhance dedication but also improve overall performance—as the level of interest often translates into learning opportunities and growth.

In summary, new entrepreneurs should devote time to understanding their own skills and interests as a precursor to making investment decisions. By focusing on low-cost investments that align with their capabilities, they can position themselves favorably in the competitive investment landscape, ultimately paving the way for more successful outcomes. This introspective approach not only mitigates risk but also lays the groundwork for making the best investments for beginners.

Investing in Digital Products

Digital products have emerged as a lucrative area for new entrepreneurs looking for low-cost investments. Unlike physical goods, digital products such as eBooks, online courses, and mobile applications require minimal overhead and can often be developed and sold with relatively low initial costs. This low barrier to entry makes them one of the best investments for beginners entering the entrepreneurial landscape.

One of the primary advantages of digital products is their high-profit margins. Once developed, these products can be sold to an unlimited number of consumers without the need for additional production costs. For instance, an online course can be created once and sold repeatedly. Similarly, an eBook can reach a global audience without the complexities associated with shipping or inventory management. This scalability presents a compelling case for investing time and resources into creating digital products.

To successfully create and market digital products, entrepreneurs should conduct thorough market research to identify potential demand and gaps in the market. Platforms such as Udemy or Amazon Kindle Direct Publishing can provide valuable insights into what types of content resonate with potential customers. Additionally, it is essential to craft high-quality content that not only informs or entertains but also provides real value to the user.

Marketing strategies also play a crucial role in the success of digital product investment. Utilizing social media, email marketing, and targeted advertising can help reach a broader audience. Building a personal brand or an online presence through blogs and webinars can also enhance credibility, drawing in customers who value expertise and trustworthiness. By leveraging effective marketing techniques, entrepreneurs can significantly increase sales of their digital products, ensuring maximum returns on their low-cost investments.

Starting a Service-Based Business

For new entrepreneurs seeking low cost investments, starting a service-based business presents a lucrative opportunity with minimal upfront expenditure. Service-oriented ventures such as consulting, freelance writing, or social media management can be initiated with limited financial resources. The key to success lies in identifying a viable service that aligns with market demands and personal expertise.

Before embarking on this path, it is essential to conduct thorough market research. Understanding the needs and challenges of potential clients can guide entrepreneurs toward the best investments for beginners. This analysis can take various forms, such as surveys, interviews, or studying industry trends. Paying attention to gaps in the market can yield insights into services that are in demand but underrepresented in the current marketplace.

Furthermore, entrepreneurs should leverage their existing skills and experiences to determine which services they can offer. For example, individuals with backgrounds in marketing might excel in social media management, while those with strong analytical skills may find success in consulting roles. This personal expertise not only adds credibility but also allows for the delivery of high-quality services, which can foster trust and client loyalty.

Moreover, establishing an online presence is critical for promoting service-based businesses. Creating a professional website and utilizing social media platforms can significantly enhance visibility and attract potential clients without substantial investment. Utilizing freelance job boards and networking opportunities can also aid in securing initial clients.

Service-based businesses are not only low-cost investments but also provide an excellent opportunity for scalability. As they gain traction and client portfolios grow, entrepreneurs can expand their offerings or increase their rates. By carefully evaluating market needs and leveraging personal strengths, new entrepreneurs can effectively position themselves for success in the service industry.

Utilizing Dropshipping as a Business Model

The dropshipping business model has emerged as one of the most appealing low cost investments for new entrepreneurs. This model allows individuals to sell products directly to customers without the need to maintain inventory. When a product is sold, the entrepreneur simply purchases the item from a third party supplier, who then ships it directly to the customer. This process significantly reduces overhead costs, making dropshipping an attractive option for those looking to dive into the world of e-commerce.

One of the primary advantages of dropshipping is the relatively low startup costs associated with starting an online store. Entrepreneurs can create a website and list products without any significant upfront investment. This adaptability is particularly beneficial for beginners, as it provides the opportunity to test various markets and niches without the financial risks typically associated with traditional retail models.

When venturing into dropshipping, selecting the right niche is crucial. Rather than attempting to sell a broad range of products, it is advisable to focus on a specific category that resonates with target customers. Researching trends, consumer preferences, and competitive pricing can guide entrepreneurs in identifying promising niches. Tools such as Google Trends and social media platforms can provide insights into what products are gaining traction and generating interest in the marketplace.

Marketing strategies play a vital role in the success of a dropshipping business. To effectively attract and retain customers, entrepreneurs should employ various online marketing tactics, such as search engine optimization (SEO), paid advertising, and content marketing. Social media platforms can also serve as effective channels for reaching potential customers and promoting products. By combining these strategies with a well-curated product catalog, entrepreneurs can create a compelling online presence that drives sales.

In conclusion, dropshipping represents a profitable and accessible model for entrepreneurs seeking low cost investments. With the right niche selection and effective marketing, individuals can establish a successful business without the burdens of traditional inventory management.

Investing in Online Real Estate

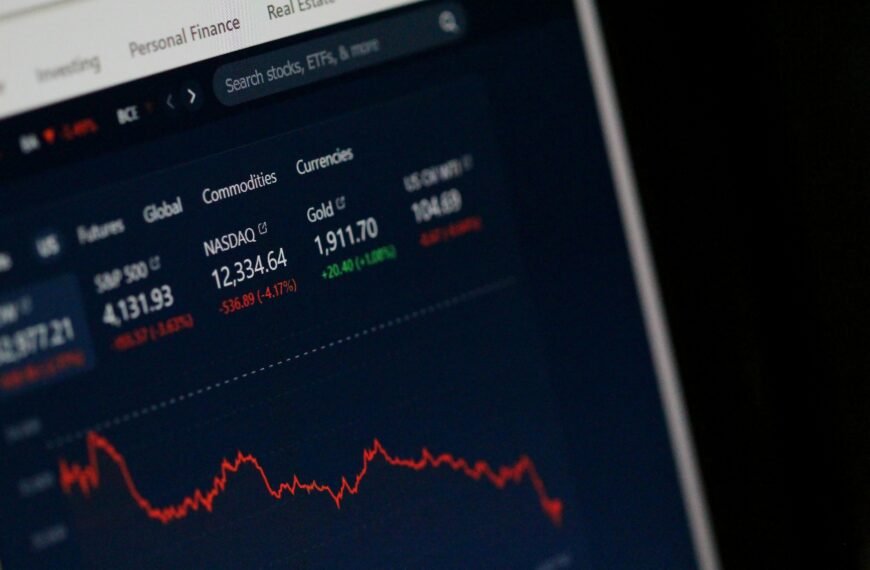

Online real estate represents a unique opportunity for new entrepreneurs looking for low-cost investments that can yield high returns. The popularity of the internet has led to a burgeoning market for domain names and websites, allowing individuals to buy, sell, or flip these digital assets. As entrepreneurs explore investment strategies, understanding the mechanics of online real estate can provide a significant advantage.

Domain names are among the most sought-after forms of online real estate. A catchy or relevant domain name can hold immense value, particularly if it aligns well with current trends or established industries. Entrepreneurs can acquire domain names that are currently available for registration or purchase existing ones from current owners at a negotiable price. Once invested, they can choose to develop the domain by building a website or simply hold onto it until the domain appreciates in value. This makes it one of the best investments for beginners due to relatively low entry barriers compared to traditional real estate.

Furthermore, investing in existing websites can be a lucrative avenue. Entrepreneurs can purchase websites that are already generating traffic and revenue. By enhancing the existing content, improving SEO, or optimizing monetization strategies, they can increase the overall value of the website. This method not only diversifies the investment portfolio but also provides the potential for substantial returns on investment. As with any investment, thorough research and due diligence are essential to assess the viability of potential purchases.

In conclusion, online real estate, encompassing domains and websites, represents a strategic and low-cost investment opportunity for new entrepreneurs. By entering this market, individuals can explore various avenues to generate income, making it an appealing choice for those looking to embark on their entrepreneurial journey. The potential for high returns makes investing in online real estate one of the best investments for beginners in today’s digital landscape.

Leveraging Social Media for Affiliate Marketing

In today’s digital marketplace, affiliate marketing stands out as one of the best investments for beginners looking to earn supplemental income with low cost investments. This marketing strategy involves promoting products or services offered by other businesses and earning a commission on each sale made through your referral link. Social media platforms provide an ideal landscape for affiliate marketers, allowing entrepreneurs to leverage vast audiences without significant upfront costs.

To get started with affiliate marketing on social media, one should begin by selecting a niche that aligns with personal interests or expertise. This will not only make it easier to create authentic content but also attract a targeted audience. Start by signing up for affiliate programs that correspond to your chosen niche, as many brands offer free registration. Platforms like Amazon Associates, ShareASale, and ClickBank are popular options providing access to a plethora of products.

Once you have your affiliate links, the next step is to build and engage an audience on social media. Focus on creating valuable content that resonates with your target demographic. This can include informative posts, reviews, or engaging stories that showcase the products you are promoting. Consistency is key; regularly posting content will help you maintain visibility and grow your following over time. Utilize platforms such as Instagram, Facebook, and Twitter to connect with potential customers and encourage them to click through your affiliate links.

To maximize income from affiliate marketing, consider employing a mix of strategies. Utilize analytics tools available on most social media platforms to monitor engagement and identify which types of posts drive the most conversions. Consider experimenting with promotions, giveaways, or paid advertisements to reach a broader audience while keeping costs low. By continuously refining your approach and staying updated on industry trends, you can effectively turn social media into a lucrative avenue for low-cost high-return investments.

Budgeting and Financial Planning for Small Investments

In the journey of entrepreneurship, effective budgeting and financial planning are crucial, particularly when it comes to low-cost investments. For new entrepreneurs, navigating the myriad of investment opportunities can be daunting. Therefore, adopting a strategic approach towards finance management can lead to sustainable business growth.

Firstly, it is essential to establish a clear budget that defines how much capital can be allocated for investments without jeopardizing the operational needs of the business. This budget should account for fixed costs, variable expenses, and potential emergency reserves. By doing so, entrepreneurs can ensure they are setting aside funds specifically for investment purposes, which can be gradually built upon as the business grows. This approach not only minimizes risk but also instills discipline in financial habits.

Once a budget is in place, the next step is to prioritize low-cost investments. Entrepreneurs should focus on areas that promise a strong return with minimal initial financial outlay. Common best investments for beginners include options such as micro-investing apps or peer-to-peer lending platforms that allow individuals to invest small amounts of capital. These platforms provide diverse investment portfolios, enabling small-time investors the opportunity to generate returns over time.

Moreover, educating oneself about different investment strategies is critical. Resources such as online courses, workshops, and financial planning consultations can provide valuable insights into how to allocate funds wisely. By understanding market trends and investment principles, entrepreneurs can make informed decisions that align with their financial goals.

In conclusion, effective budgeting and strategic planning enable new entrepreneurs to manage their finances efficiently, ensuring that even a small amount of capital can be invested wisely across various opportunities. By focusing on low-cost investments and prioritizing education, one can lay a solid foundation for future business success.

Conclusion: Taking Action and Making Smart Investments

In the competitive landscape of entrepreneurship, the significance of making low-cost investments cannot be overstated. As new entrepreneurs embark on their journey, understanding that prudent financial decisions can yield substantial returns is essential. By focusing on best investments for beginners, such as low-cost index funds, peer-to-peer lending, or investing in your own skills, individuals can create a stable foundation for future growth.

Starting small is a crucial aspect for anyone looking to invest wisely. Many successful entrepreneurs began their investment journey with modest sums, gradually expanding their portfolios as they gained experience and confidence. By embracing a strategy tailored to low-cost investments, new business owners can mitigate risks while allowing their financial assets to flourish over time. It is important to conduct thorough research and assess potential investment opportunities carefully. This approach helps entrepreneurs make more informed choices, ensuring that their financial resources are directed towards ventures with higher potential returns.

Additionally, patience should be a guiding principle in the investment process. Recognizing that substantial gains may take time to materialize can alleviate the pressure often associated with immediate results. Building wealth through investments often resembles a marathon rather than a sprint. It’s vital for entrepreneurs to remain committed to their investment strategy, monitor progress, and adjust methods as needed. In essence, a disciplined, patient approach paired with low-cost investment strategies can set the stage for sustainable growth and success.

In conclusion, by incorporating these insights into their investment practices, new entrepreneurs can cultivate a successful financial journey. Emphasizing the importance of starting small and staying patient while exploring low-cost investment options can lead to significant rewards in the long term. Taking action today can pave the way for a prosperous future.

We publish content to inspire and motivate the new generation.