Introduction to Wealth Measurement

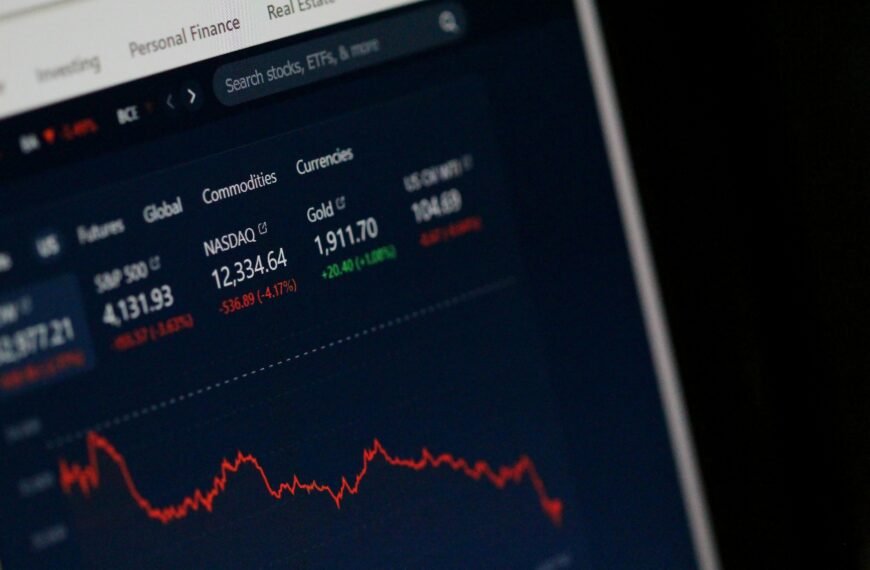

The measurement of wealth within a country is a multifaceted concept that relies on various economic indicators to assess the overall prosperity of a nation. Understanding these metrics is crucial for evaluating which country may be deemed the richest in the world. Among the most prominent indicators are Gross Domestic Product (GDP), Gross National Income (GNI) per capita, and Purchasing Power Parity (PPP). Each of these elements provides valuable insights into the economic health and living standards of a nation’s population.

Gross Domestic Product (GDP) represents the total monetary value of all goods and services produced within a country’s borders over a specific period, typically calculated annually. This broad measure highlights the economic activity and productivity levels of a country, providing a foundation for comparison against other nations. However, GDP alone does not account for population differences, which is why analysts often turn to additional metrics for a more comprehensive assessment.

Gross National Income (GNI) per capita complements GDP by accounting for the total income earned by a nation’s residents, whether generated domestically or from abroad, divided by the population. This indicator fulfills a vital role in assessing the average income and standard of living for individuals within a country, offering a more refined perspective on economic well-being compared to GDP alone.

In addition to these indicators, Purchasing Power Parity (PPP) is another critical tool for understanding wealth measurement. PPP adjusts for price level differences across countries, allowing for more equitable comparisons of income and consumption patterns. By evaluating a country’s economic output and income levels through GDP, GNI per capita, and PPP, one can better comprehend the nuances that contribute to recognizing the richest country in the world.

Current Rankings of Wealthy Nations

The assessment of what is the richest country in the world often varies based on the metrics used for evaluation. As of the latest data, countries like Qatar, Luxembourg, and Singapore frequently occupy the top positions in global wealth rankings. These nations are recognized not just for their affluence but also for the economic strategies that contribute to their financial prosperity.

Qatar, for instance, is consistently acknowledged as one of the richest nations due to its vast oil and natural gas reserves. According to reports, Qatar boasts a GDP per capita of approximately $65,000, positioning it among the leading countries worldwide. Its economy is robust, reliant on energy exports, which enable substantial public investment and social development programs. The government’s forward-thinking approach, including diversification into sectors like tourism and finance, further solidifies its standing as a wealthy nation.

Luxembourg, another key player, often ranks just behind Qatar in wealth metrics. Its GDP per capita is incredibly high, nearing $115,000. Luxembourg’s dynamic financial sector, characterized by a comprehensive investment framework and low corporate taxes, attracts multinational corporations, thereby enhancing its economic profile. Additionally, the stable political environment and an educated workforce augment its appeal as a business hub in Europe.

Singapore rounds out the list of the richest countries, with a GDP per capita of around $95,000. The nation’s strategic location as a global trade nexus, combined with a strong emphasis on technological innovation and a pro-business regulatory framework, has created a thriving economy. The government has invested heavily in infrastructure and education, allowing Singapore to emerge as a significant financial center in Asia.

In conclusion, the current rankings of the richest countries highlight how both natural resources and strategic economic policies shape a nation’s wealth. Qatar, Luxembourg, and Singapore exemplify how diverse approaches can lead to significant financial success on the global stage.

Understanding GDP and GNI

Gross Domestic Product (GDP) and Gross National Income (GNI) are two crucial metrics used in the evaluation of a country’s economic performance. While both indicators provide insight into national wealth, their calculations and implications vary significantly. GDP refers to the total monetary value of all goods and services produced within a country’s borders over a specific time frame, typically measured annually. This metric is fundamental for assessing the economic health of a nation and is often viewed as an indicator of its economic activity.

On the other hand, GNI offers a different perspective on national wealth by accounting for the income earned by residents of a country, regardless of where that income is generated. This means that GNI includes the total income received by a country’s residents from abroad, such as dividends, interest, and remittances, while excluding income earned by foreign residents within the country. This distinction highlights the importance of international economic relations and foreign investments in determining what is the richest country in the world.

The relevance of GDP and GNI extends beyond mere numerical representation; they play vital roles in public policy formulation, investment planning, and international comparisons. For instance, a country may exhibit a high GDP yet falter in GNI due to significant capital outflows. Conversely, nations with robust income from overseas may display higher GNI figures in relation to GDP, indicating a wealth level that does not necessarily correspond to domestic production alone.

Countries such as Luxembourg and Qatar, often tagged as among the richest, showcase how GNI can sometimes better reflect the wealth of a nation than GDP alone. Thus, understanding the interplay between GDP and GNI is essential for grasping the complexities of defining wealth on a national level and assessing what truly indicates the richest country in the world.

Key Factors Contributing to Wealth

The wealth of a nation is a multifaceted construct influenced by various economic elements. When assessing what is the richest country in the world, it is essential to identify and analyze the fundamental factors that contribute to its economic success. Among these, the abundance of natural resources plays a pivotal role. Countries rich in natural assets, such as oil, minerals, and fertile land, tend to enjoy a significant economic advantage. For instance, nations in the Middle East are often highlighted as affluent due to their vast oil reserves, which serve as powerful drivers of wealth and economic stability.

In addition to natural resources, the industrial capabilities of a nation significantly determine its economic standing. Countries that excel in manufacturing and technology, such as Germany and Japan, demonstrate how a robust industrial sector contributes to overall wealth. These nations efficiently convert raw materials into high-value products, thereby generating substantial income streams. Moreover, innovation serves as a cornerstone of economic growth. Nations prioritizing research and development, such as the United States, often experience increased productivity and a high standard of living, reinforcing their status in global rankings.

Trade policies also profoundly impact a nation’s wealth. Countries that engage in beneficial trading partnerships and maintain a favorable balance of trade can bolster their economies effectively. For instance, Singapore, despite its limited natural resources, thrives through strategic trade agreements and a business-friendly environment, showcasing that sound economic policies can elevate a country’s wealth. Finally, it is crucial to consider the interplay of these factors, as they collectively shape the economic landscape of the richest country in the world and contribute to its sustained prosperity.

The Role of Government Policies

Government policies play a crucial role in shaping the economic landscape of a nation, significantly influencing wealth and prosperity. Among the various components that contribute to a country’s economic success are taxation, welfare programs, business regulations, and education systems. These elements combine to create an environment conducive to growth and wealth creation. One key aspect is how taxation policies can either stimulate or deter investment. Countries with favorable tax regimes often attract foreign direct investment, bolstering economic activity. For instance, nations like Singapore and Luxembourg have implemented low corporate tax rates, encouraging businesses to establish operations and contribute to national wealth.

Welfare policies are another vital factor in determining a nation’s economic health. Effective welfare programs can reduce inequality and promote social stability, allowing citizens to pursue education and employment opportunities, thereby enhancing productivity. Scandinavian countries such as Sweden and Norway exemplify this balance, demonstrating how comprehensive welfare systems can lead to a high quality of life while maintaining a competitive economy. These nations have cultivated an environment where social safety nets support individual aspirations without stifling economic incentives.

In addition to taxation and welfare, regulations governing business operations also significantly impact economic dynamics. Countries with a streamlined regulatory framework, such as New Zealand and Denmark, typically foster an entrepreneurial culture, resulting in increased innovation and wealth generation. By minimizing bureaucratic hurdles, these nations promote a thriving marketplace, driving economic growth and enhancing their global competitiveness. Furthermore, investment in education systems aligns closely with economic success. Countries that prioritize education tend to produce a skilled workforce ready to engage in high-value industries, substantially contributing to national income. Collectively, these factors underscore the essential role of government policies in cultivating economic prosperity, making a significant impact on what is the richest country in the world.

Challenges Faced by Wealthy Nations

Despite their immense wealth and resources, the richest countries in the world encounter a myriad of challenges that threaten their overall prosperity and stability. Economic disparity is a significant issue, as wealth is often concentrated among a small segment of the population. This uneven distribution can lead to social unrest, political instability, and a decline in quality of life for those who are economically marginalized. In nations regarded as the wealthiest, the stark contrast between affluence and poverty can catalyze movements advocating for social equity and justice, further complicating governance.

Another crucial challenge these affluent nations face is sustainability. The extraction and consumption of natural resources, while initially beneficial for economic growth, often raise concerns about environmental degradation and the long-term viability of resources. Countries rich in oil, minerals, and other resources must grapple with the impacts of overexploitation and the need for environmental stewardship. Moreover, as climate change continues to escalate, wealthy nations are increasingly tasked with finding sustainable solutions that balance economic growth with ecological preservation, putting pressure on existing industries and practices.

Geopolitical issues also heavily influence the status and stability of the richest countries. Economic ties, trade agreements, and international relations are complex and can be frequently destabilized by conflicts, rivalries, and shifting alliances. A wealth disparity not only exists within these nations but also on a global scale, leading to tensions with developing economies. For instance, countries that are considered affluent may face criticisms for their foreign policies, which could be perceived as exploitative or dismissive of the needs of less wealthy nations. As a result, the richest country in the world must navigate these intricate dynamics carefully to maintain both their wealth and global standing.

Comparative Analysis with Emerging Economies

The wealth landscape globally is diverse, with the richest country in the world standing out due to its advanced economic infrastructure and substantial GDP. However, emerging economies offer compelling narratives of growth and resilience that merit examination. A comparative analysis indicates that while wealthier nations possess sophisticated service sectors and capital-rich industries, emerging economies often operate on different growth trajectories, prioritizing rapid industrialization and export-driven models.

For example, countries such as India and Brazil exhibit unique economic structures characterized by a mix of agriculture, manufacturing, and services. These nations are witnessing remarkable growth rates, often surpassing those of established economies. In contrast to the richest country in the world, which relies on a high degree of technological advancement and innovation, emerging markets reflect an ongoing transition where young labor forces and entrepreneurial initiatives play crucial roles in their climbing economic standings.

Moreover, the wealth accumulation strategies in these nations reveal important lessons for richer countries. Emerging economies often emphasize sustainable practices, balancing growth with environmental considerations. They are increasingly aware of the importance of integrating sustainability into their economic frameworks, which contrasts with conventional models still prevalent in wealthier nations. Investments in renewable energy, sustainable agriculture, and environmentally friendly industries exemplify how emerging markets are not just aiming for growth but also fostering long-term stability and environmental stewardship.

This comparative analysis illustrates that the richest country in the world can draw valuable insights from emerging economies. By adopting sustainable economic practices and appreciating the diverse strategies employed by these nations, wealthier countries can enhance their economic resilience and ensure more equitable global growth. The collective future of both rich and emerging nations could greatly benefit from shared knowledge and collaboration in building prosperous economies that do not compromise ecological integrity.

Future Trends in Global Wealth Distribution

The landscape of global wealth distribution is constantly evolving, influenced by a myriad of factors including technology, globalization, and demographic changes. As we envision the future, it is crucial to assess how these elements could redefine what is understood as the richest country in the world. Technological advancements, particularly in artificial intelligence and automation, have the potential to create avenues for economic growth, yet they may also exacerbate income inequality. Countries that embrace these technologies could see significant wealth generation, while those that lag may find themselves struggling.

Globalization continues to reshape the economic framework, allowing nations to engage more dynamically in international trade. As emerging markets gain a foothold, wealth distribution may become less concentrated in historically affluent countries. This shift could lead to the emergence of new contenders for the title of the richest country in the world, as developing economies harness global markets to elevate their economic status. Additionally, enhanced communication platforms enable countries to share resources and innovations more freely, potentially leveling the playing field.

Demographic trends also play a crucial role in wealth distribution. With an aging population in many developed nations, there will likely be increased pressure on social services and pension systems, which could divert national resources and economic focus. Conversely, younger populations in developing countries may drive innovation and economic agility, fostering a new era of wealth generation. The balance between these demographic shifts could directly impact how wealth is distributed globally.

As these factors interplay, the implications for economic policies and international relations become increasingly significant. Countries will need to navigate these trends carefully to promote sustainable growth and equity in wealth distribution. Understanding these dynamics will be essential in forecasting the future of the richest countries and the evolving definitions of wealth and prosperity on a global scale.

Conclusion: The Dynamics of Richness

The exploration of what is the richest country in the world reveals an intricate web of factors contributing to national wealth. While many might instinctively point towards traditional economic metrics such as Gross Domestic Product (GDP) or natural resource availability, the reality is considerably more nuanced. Wealth is influenced by a combination of political stability, social equity, technological advancement, and even cultural factors. As we have seen, nations like Luxembourg continue to top the lists not solely due to their financial sectors but also due to their governance structures and innovative economies.

Moreover, our understanding of what constitutes wealth has evolved over time. In earlier eras, wealth was predominantly equated with the abundance of physical resources or land ownership. In contrast, the contemporary definition now embraces the role of digital economies and human capital. Countries that effectively harness technology, foster education, and create inclusive environments are often more prosperous than those rich in minerals but lacking in development strategies. The shifting paradigms suggest that wealth is not static; it reflects the adaptability and strategic foresight of nations as they navigate global challenges.

As we contemplate the future of wealth on a global scale, the importance of continuous analysis becomes evident. The dynamics of wealth are in constant flux, influenced by globalization, climate change, and socio-political shifts. The richest countries today may face new challenges and competitors tomorrow. It becomes imperative for stakeholders, including policymakers and businesses, to remain vigilant and adaptable. The evolving landscape of wealth demands a forward-looking approach, where understanding and responsiveness to emerging global trends will define not only individual nations’ fortunes but also the interconnected financial tapestry of our world.

We publish content to inspire and motivate the new generation.